New users get 50% off payroll for the first three months. QuickBooks makes it easy to process payroll and reconcile your payroll liabilities. You may do this annually, but doing it monthly saves more time in the long run.Īdding QuickBooks Payroll to your existing QuickBooks Online subscription means that your business is granted instant access to payroll processing features and HR tools. This consists of researching outstanding payroll debts, like payroll taxes or benefit premiums, that haven’t cleared your general ledger accounts in a reasonable time frame.

QUICKBOOKS PAYROLL TUTORIAL 2017 HOW TO

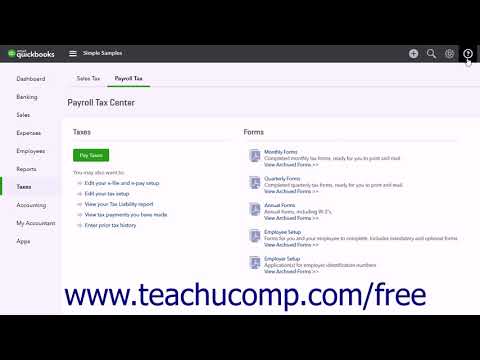

There are, however, important related tasks, like learning how to reconcile payroll liabilities in QuickBooks. When reconciling payroll, many QuickBooks Payroll users are concerned with aligning their payroll records to their bank statements. How to Manage Credit Card Sales With a Third-party Credit Card Processor How to Manage Credit Card Sales With QuickBooks Payments How to Reconcile Business Credit Card Accounts How to Manage Downloaded Business Credit Card Transactions How to Enter Business Credit Card Transactions Manually

Part 5: Managing Business Credit Card Transactions

How to Handle Bounced Checks From Customers How to Transfer Funds Between Bank Accounts How to Manage Downloaded Banking Transactions How to Enter Banking Transactions Manually How to Set Up the Products and Services List How to Set Up Invoices, Sales Receipts & Estimates How to Customize Invoices, Sales Receipts & Estimates

0 kommentar(er)

0 kommentar(er)